1102 · Previously, nonemployee compensation has been reported on Form 1099MISC; · The IRS released a draft Form 1099MISC that excluded Box 7 for reporting nonemployee compensation Form 1099NEC confirmed on August 19, For the filing season, the 1099NEC won't be applicable Form 1099NEC expected to need for the tax filing season for payments of nonemployee compensation2309 · If you're accustomed to filing Form 1099MISC to report nonemployee compensation, you'll need to reorder your IRS alphabet for your returns The government is now bringing back Form 1099NEC

Hhm

How to file 1099 misc nonemployee compensation

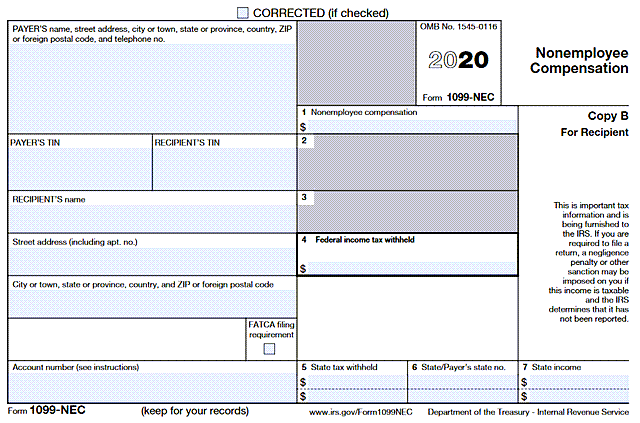

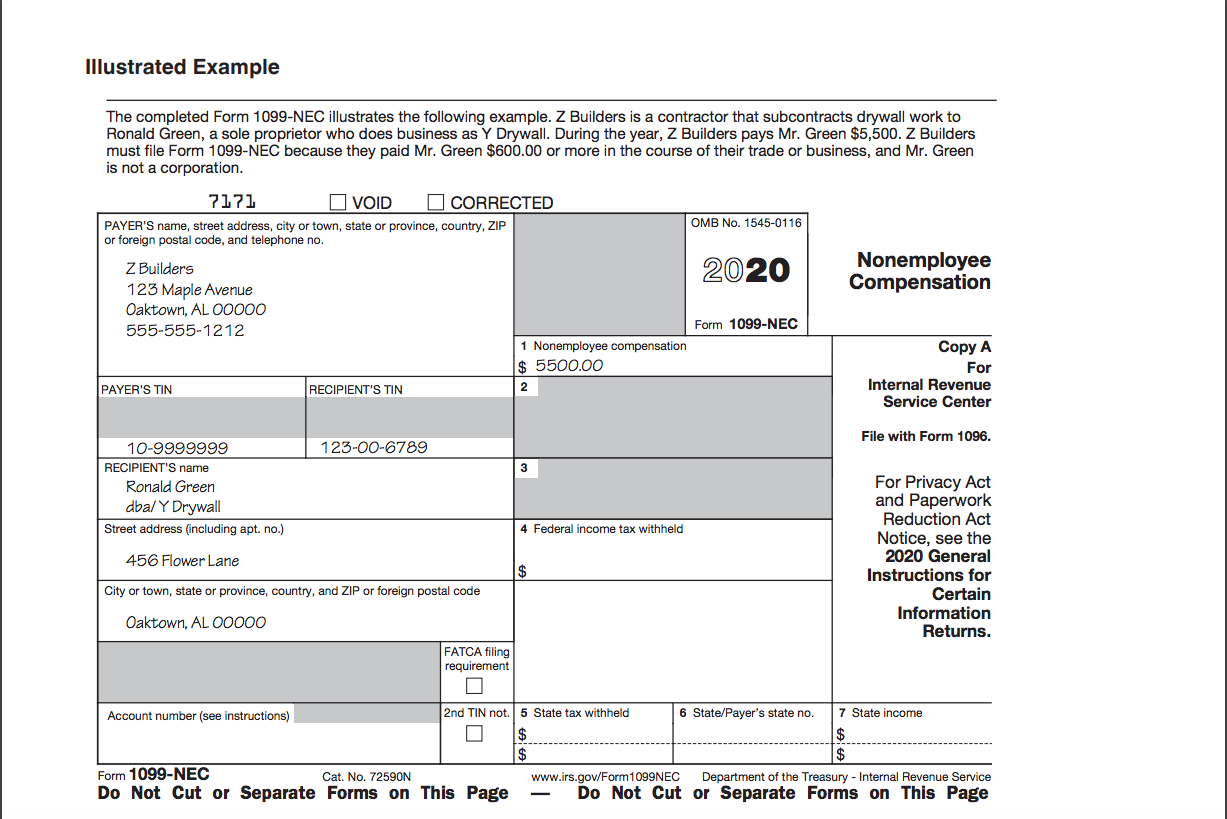

How to file 1099 misc nonemployee compensation-1811 · FORM 1099NEC Starting in tax year , Form 1099NEC will be used to report compensation totaling more than $600 (per year) paid to a nonemployee for certain services performed for your business Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in Box1812 · What is nonemployee compensation?

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

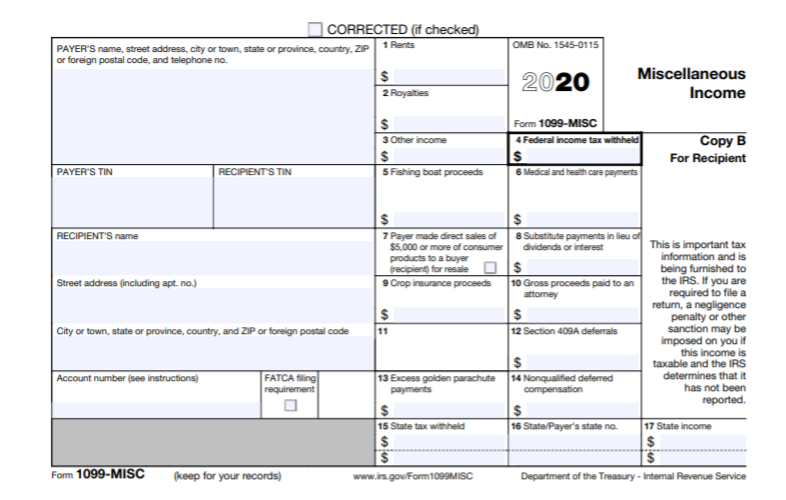

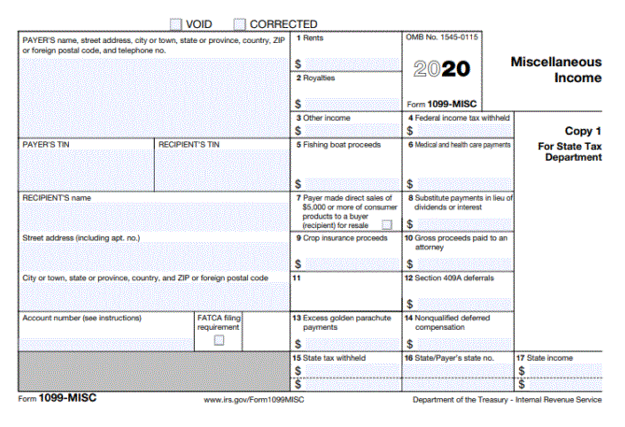

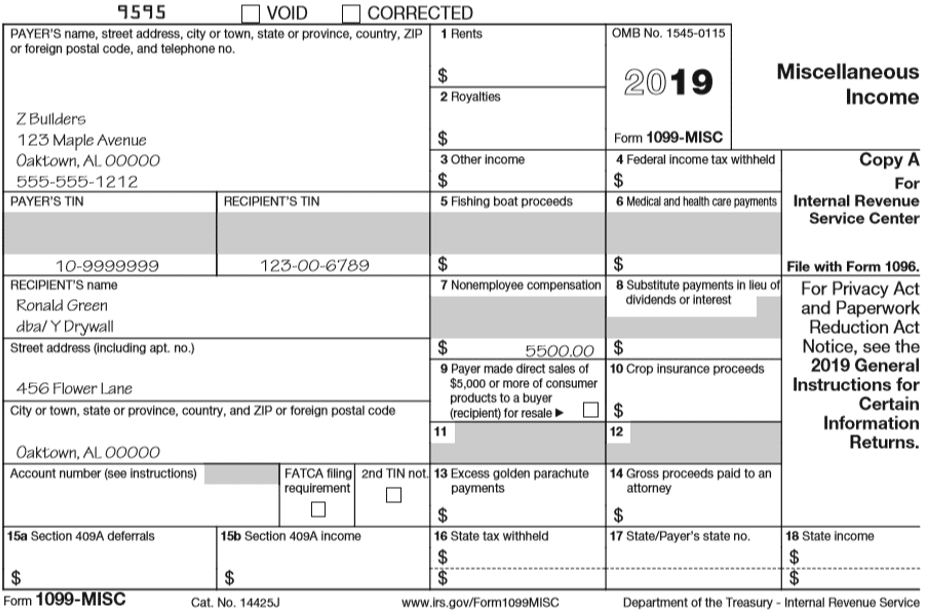

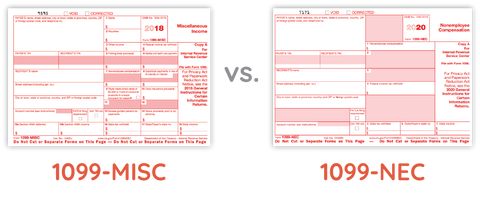

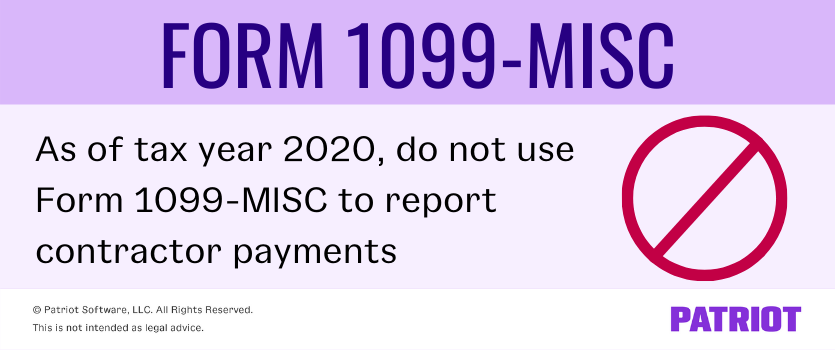

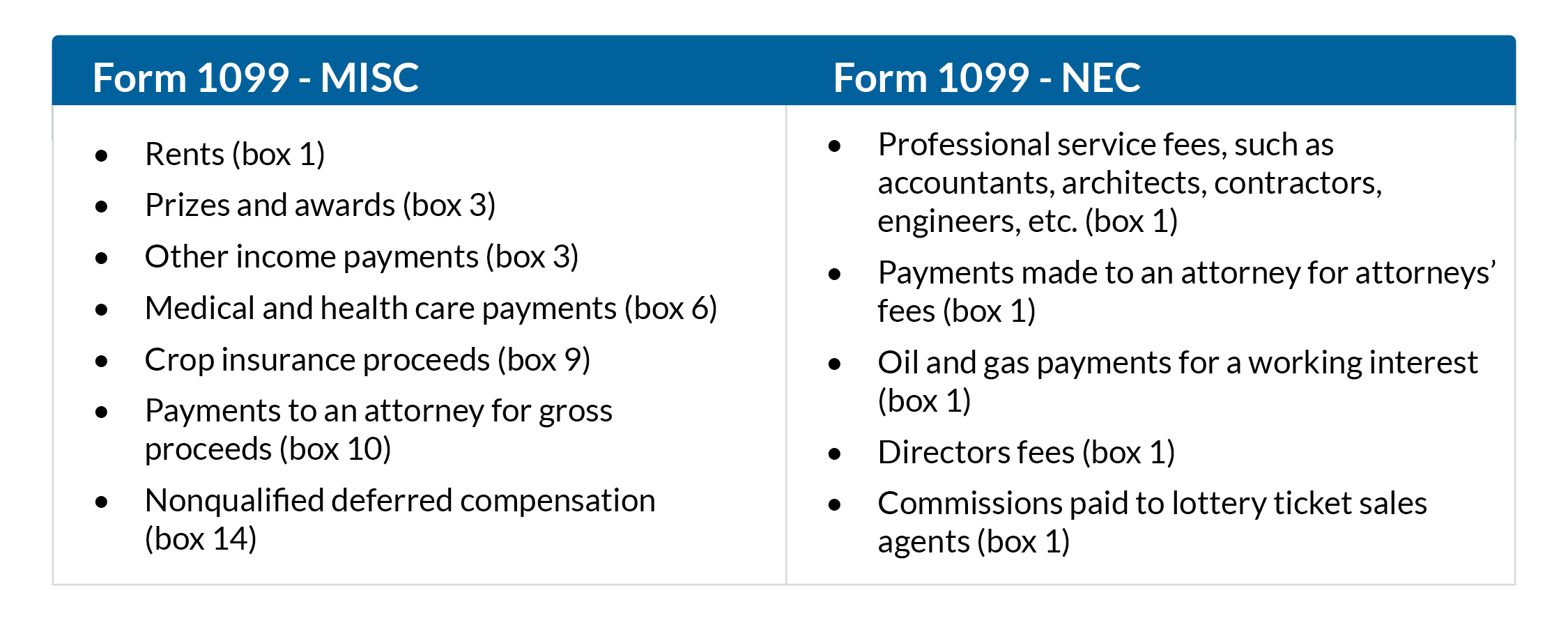

0112 · This year's Form 1099MISC reporting includes a major change that will impact most filers in some way For and years going forward, nonemployee compensation reporting has been removed from the Form 1099MISC and must be reported on the new Form 1099NEC Join us for a webcast addressing updated requirements, deadlines, and complications regarding statePayments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation (NEC) This new Form 1099NEC will only be used for reporting Nonemployee Compensation, while the 1099MISC will continue to be used for other types of payments traditionally reported on the Form 1099MISCForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income

0421 · The new Form 1099MISC included nonemployee compensation and other payments, such as rents, prizes, awards, and medical payments—and Form 1099NEC was no longer needed But this change also added2511 · To avoid the confusion of having two deadlines for the same form 1099MISC, the IRS introduced 1099NEC for the tax year to report nonemployee compensation If you would like to efile Form1609 · Sep 16, The IRS has released form 1099NEC (NonEmployee Compensation) for reporting money a business pays to independent contractors This new form will replace box 7 on the 1099MISC form

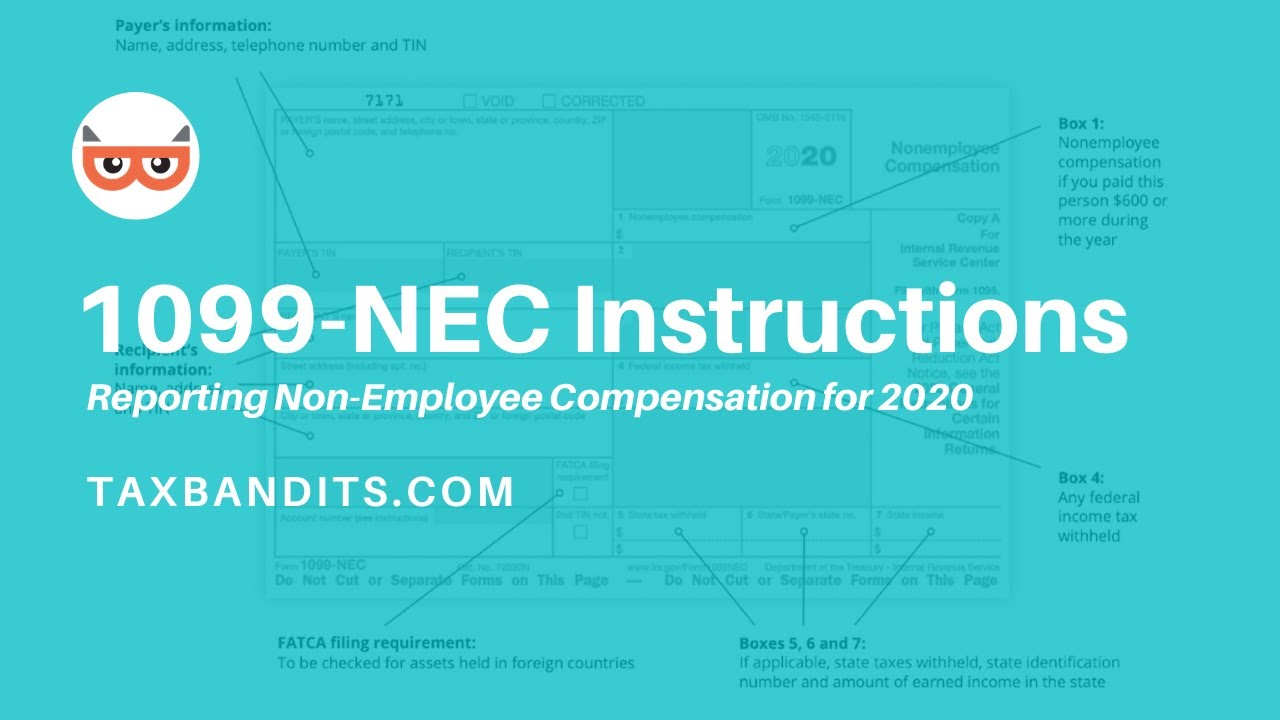

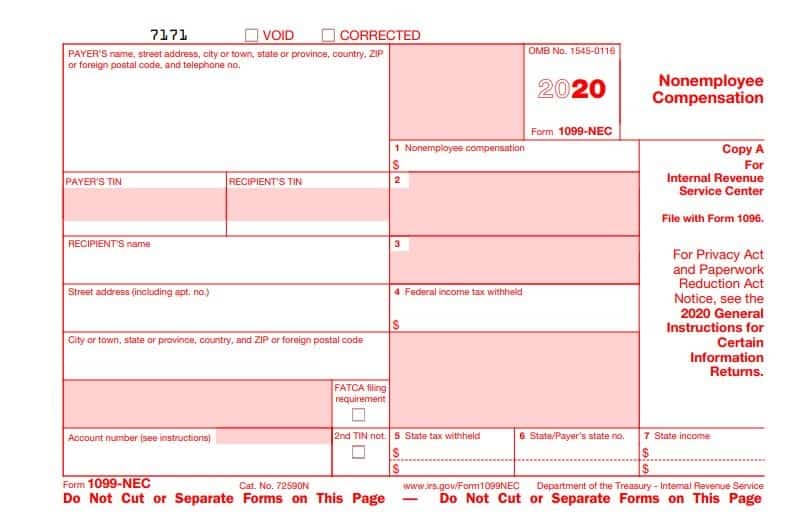

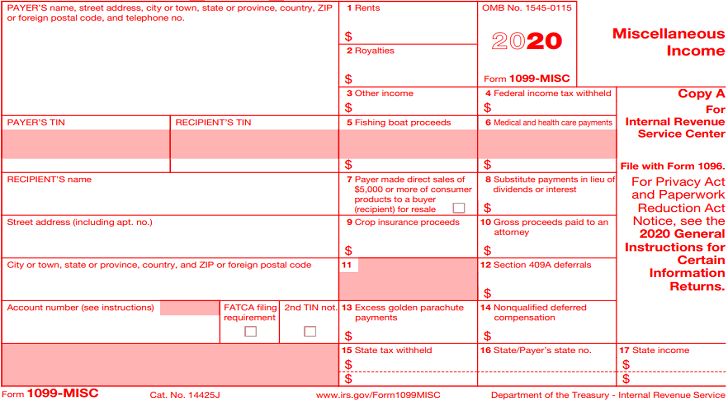

· So, while EFiling 1099 NEC Form, choose the box 1 that is nonemployee compensation and then enter your payment amount in the box 1 Before submitting your Federal 1099 NEC to the IRS and to your nonemployee, you must check the below details are correct orNonemployee compensation reporting has removed from the 1099MISC Tax Form for The major change is Box 7, which previously used for reporting nonemployee compensation Now, Box 7 used for direct sales of $5,000 or more Other information on the form has been reassigned to different box categoriesStarting with compensation paid this year, this compensation will be reported on new Form 1099NEC Introducing Form 1099NEC Form 1099NEC will be used to report any compensation paid to nonemployees, including outside directors, consultants, and independent contractors

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

The terminology between gig worker, independent contractor and freelancer can all be a bit confusing, especially since they are used interchangeably in the media For reference, the IRS defines nonemployee compensation in the Instructions for Forms 1099MISC and 1099NEC () as the following10 · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation (NEC) on the new Form 1099NEC, instead of on Form 1099MISC This is an important change as almost all companies are subject to annual reporting requirements involving these information returns2110 · Beginning in , the IRS has split the 1099 into two separate forms Form 1099NEC (for nonemployee compensation) and Form 1099MISC (for other miscellaneous service payments) Form 1099NEC Nonemployee compensation of $600 or

1099 Nec A New Way To Report Non Employee Compensation

1099 Misc Form Copy A Federal Discount Tax Forms

A new 1099NEC form has been introduced by the IRS for It is actually an old form that hasn't been in use since 19 Prior to , organizations could file one Form 1099MISC to report nonemployee compensation and miscellaneous income items by February 28 each year0612 · December 6, 218 PM @roperwin1544 When you receive the 1099 for "nonemployee compensation" is will not look like it did before No longer will it be on a 1099MISC in box 7 it will be on a new 1099NEC form that the03 · Form 1099NEC (previously retired in 19) replaces Box 7 of the pre Form 1099MISC for reporting nonemployee compensation and accelerates the due date for reporting nonemployee compensation

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

What Is Form 1099 Nec

· The IRS has separated nonemployee compensation onto a new form called the 1099NEC for tax year Because of this, the IRS has revised Form 1099MISC and rearranged box numbers for reporting certain income1502 · Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISC Subsequently, box 7 on form 1099MISC for tax year has been removed Actually, this new form was an old form that has not been in use since 19 Because there were separate filling dates for box 7 on the 1099MISC and the other types ofInstantly File 1099 Misc Online Form You should report 1099 Misc Form to the IRS by February 1st, 21 Efile 1099 Misc with simple 3 steps and at an affordable price Grab all the benefits to File 1099 Misc Form Check The Form IRS 1099NEC If you make a bug on federal tax 1099 NEC form, You pay IRS penalty so you must provide a

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1310 · Instructions for Form 1099MISC Because nonemployee compensation reporting has been removed from Form 1099MISC for the tax season and beyond, the IRS has redesigned Form 1099MISC The biggest change is Box 7, which was previously used for reporting nonemployee compensation1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensation See part C in the General Instructions for Certain0607 · There is a new Form 1099NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation Starting in tax year , payers must complete this form to report any payment of $600 or more to a payee Generally, payers must file Form 1099NEC by January 31 For tax returns, the due date is February 1, 21

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Hhm

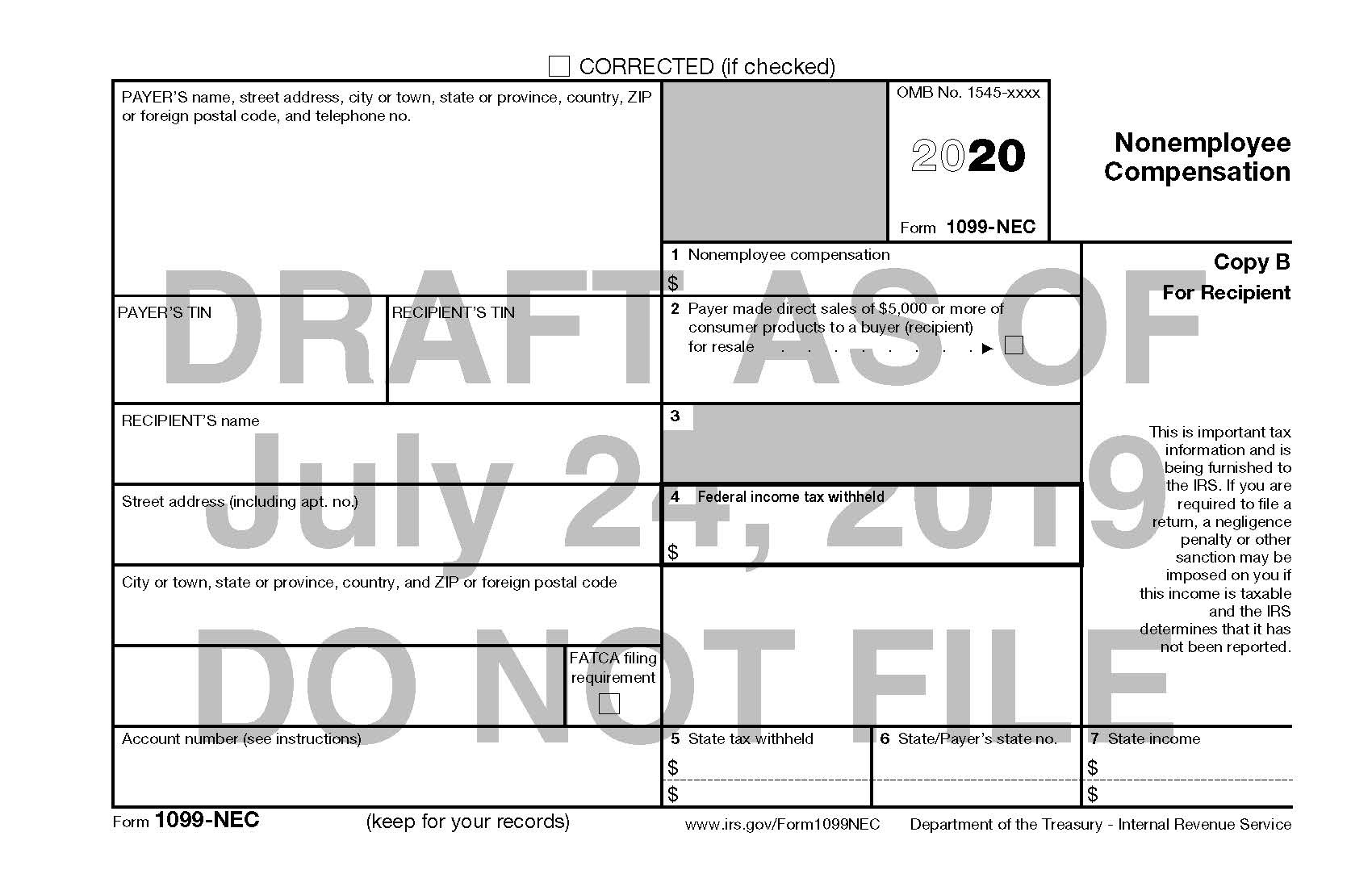

· Form 1099MISC is used to report payments that are not nonemployee compensation Form 1099MISC is due on March 1, 21, if filed by paper, or March 31, 21, if electronically filed The instructions for both the Form 1099NEC and 1099MISC are combined and can be found on the IRS website · The draft of new information form for that is to report nonemployee compensation was released July 24 by the IRS The draft of Form 1099NEC, Nonemployee Compensation, is to replace the amount of compensation paid to independent contractors that is reported in Box 7 of Form 1099MISC2311 · Nonemployee compensation for years has been reportable on line 7 of Form 1099MISC, but beginning with forms, filers instead will report nonemployee compensation on Form 1099NEC This change, we are told, is designed to "increase compliance"

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Form Copy B Recipient Discount Tax Forms

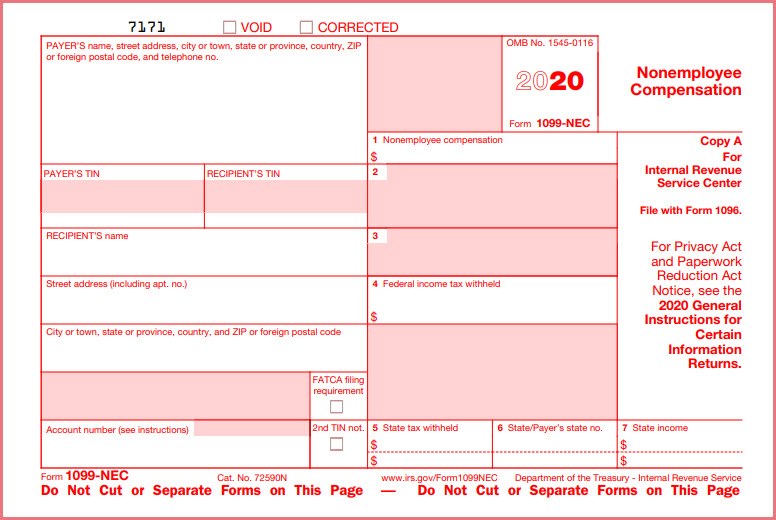

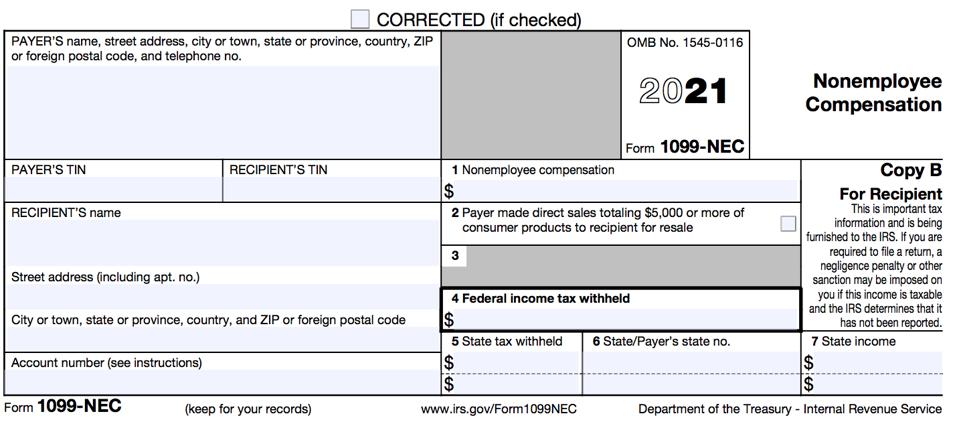

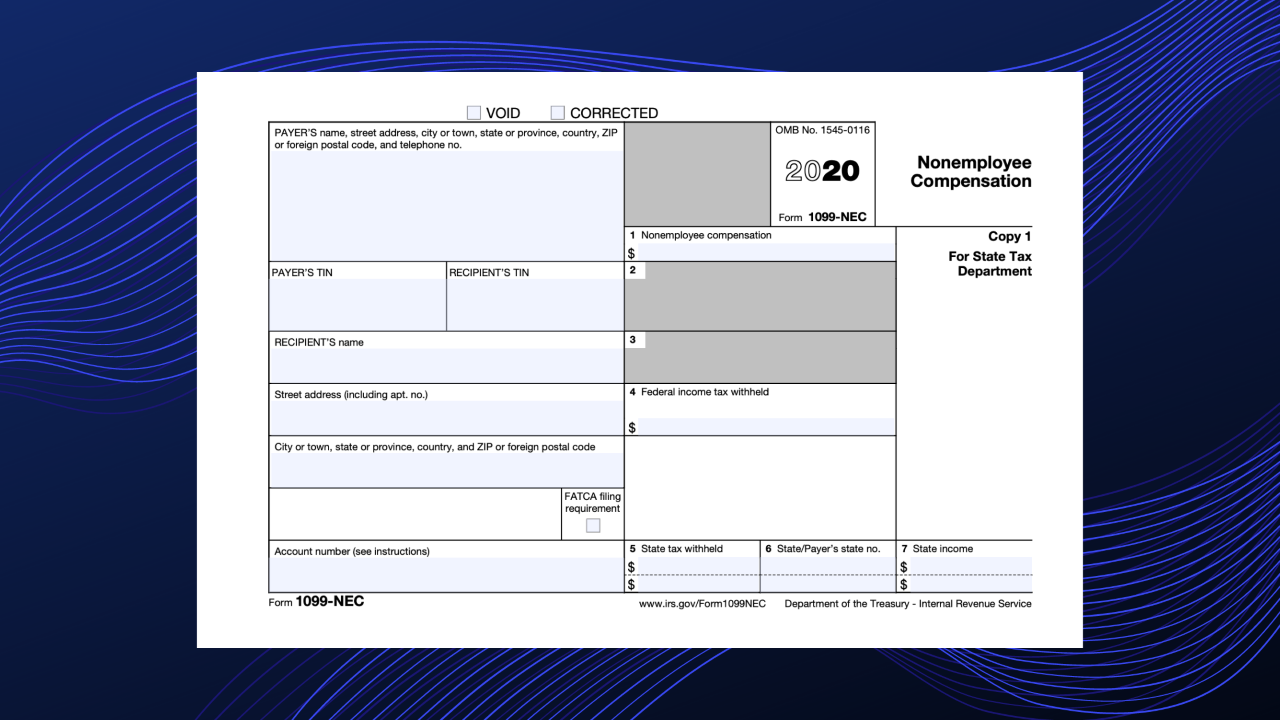

1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 7171 VOID CORRECTED2112 · Companies that make payments to nonemployee service providers and vendors could face a challenging Form 1099 reporting season for because of this new form Background of Form 1099MISC Before the 15 Protecting Americans from Tax Hikes Act (PATH Act), taxpayers could file one Form 1099MISC with the IRS to report nonemployee compensation and miscellaneousIf you received a Form 1099MISC Miscellaneous Income instead of a Form W2 Wage and Tax Statement, the income you received is considered nonemployee compensation or selfemployment income Selfemployed status means that the company or individual you worked for didn't withhold income tax or Social Security and Medicare tax

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

2709 · If you're accustomed to filing Form 1099MISC to report nonemployee compensation, you'll need to reorder your IRS alphabet for your returns The government is now bringing back Form 1099NEC for that purpose, a form that was last used in 19, during the Reagan administration2221 · Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NEC PDF Information about Form 1099NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to file · Payments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation (NEC) This new Form 1099NEC will only be used for reporting Nonemployee Compensation, while the 1099MISC will continue to be used for other types of payments traditionally reported on the Form 1099MISC

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

· Reading Time 3 minutes After a 38year absence, Form 1099NEC has made its return in the tax year, and its January 31 deadlines are right around the corner Don't panic – here's everything you need to know about the revived form, and how it is intended to be used For the last few decades, business owners were responsible for using Form 1099MISC to report nonemployee compensationUntil 15, the deadline to file 1099 MISC with nonemployee compensation and other miscellaneous payments was February 28 In 15, the introduction of the Protecting Americans from Tax Hikes Act changed the deadline to January 31 for filing 1099MISC with non employee compensation specifically0121 · Solved 1099NEC replaces 1099MISC box 7 for nonemployee compensation for Where do you input 1099NEC info in TurboTax I can't find it

1099 Misc 1099 Express

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

0505 · Form 1099NEC will replace Form 1099MISC for reporting nonemployee compensation beginning with the tax year This means that for the 21 tax season, businesses will need to file Form 1099NEC to report nonemployee compensation paid during theThe January 31 filing deadline applies only to Form 1099MISC with an amount in Box 7 (nonemployee compensation) The filing due date for other Forms 1099 not reporting nonemployee compensation remains February 28, 19 if filing by paper, and March 31, 19 if filed electronicallyBeginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

0500 · 1099MISC reported nonemployee compensation in Box 7 for over thirty years Then, in July of 19, the IRS announced Box 7's reassignment to direct sales and the reinstatement of Form 1099NEC The first year Form 1099NEC is required is 21 for payments made in2904 · If you make qualifying payments to nonemployees in , you'll need to file Form 1099NEC in the 21 tax season This incoming form is replacing Form 1099MISC for reporting nonemployee compensation Here's everything you need to know about Form 1099NEC—when to use it, how to fill it out, and filing deadlinesBeginning for tax year , business taxpayers must report nonemployee compensation using the 1099NEC Form Prior to , payers completed form 1099MISC to report nonemployee compensation of $600 or more in box 7 Form 1099MISC has been redesigned and no longer includes employee compensation Instead, the IRS reintroduced form 1099NEC to simplify the

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Public Documents 1099 Pro Wiki

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Information Reporting Reminders Bkd Llp

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Form 1099 Nec What It S Used For Priortax Blog

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Nonemployee Compensation 1099nec

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Irs To Reinstate Form 1099 Nec Requests Comments On Draft

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Need To File 1099 Misc For 18 What You Need To Know S J Gorowitz Accounting Tax Services P C

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Irs Launches New Form Replacing 1099 Misc For Wicz

How To Use The New 1099 Nec Form For Dynamic Tech Services

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Acumatica 1099 Nec Reporting Changes Crestwood Associates

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

How To Add 1099 Nec To Your Sage 100 Tax Forms

1099 Nec Form Copy B Recipient Zbp Forms

Tax Updates Form 1099 Atlanta Tax Cpas

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Understanding Form 1099 Misc And Changes That Are Coming In S J Gorowitz Accounting Tax Services P C

1099 Nec Form Copy B 2 Discount Tax Forms

Upcoming 1099 Changes Escape Technology

Form 1099 Nec For Nonemployee Compensation H R Block

How Has Form 1099 Misc Changed With The Return Of Form 1099 Nec

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Isjo3fcy4zjf M

1099 Nec 1099 Express

Changes In 1099 Reporting For Tax Year Form 1099 Nec

Form 1099 Nec Officially Replaces 1099 Misc For Reporting Payments To Nonemployees Salt Lake City S Cpa S

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Form 1099 Nec What Does It Mean For Your Business

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Is Your Business Prepared For Form 1099 Changes Rkl Llp

What Is Irs Form 1099 Misc Weny News

Self Employed Vita Resources For Volunteers

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Irs 1099 Misc Vs 1099 Nec Inform Decisions

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

New Irs Form 1099 Nec For Nonemployee Compensation Vero Beach Fl Accountant Kega Cpas

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

The New Form 1099 Nec And The Revised 1099 Misc Are Due Soon Holcombe Holtzclaw Ravan Llc

T33jd0pwcbpmtm

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

1099misc Filing Forms Software E File Zbpforms Com

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For Boyer Ritter Llc

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Your Ultimate Guide To 1099s

Use Form 1099 Nec To Report Non Employee Compensation In

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Irs Tax Form 1099 Nec What It Is And What You Need To Know To Use It Blog For Accounting Quickbooks Tips Peak Advisers Denver

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

0 件のコメント:

コメントを投稿